Executive Summary

Carbon markets are entering a critical phase. Stakeholders across industries are demanding high-integrity carbon credits that deliver verifiable, durable impact. Industrial hemp—long recognized for its versatility in fiber, food, and regenerative agriculture—is now emerging as a cornerstone in soil organic carbon (SOC) sequestration and biochar-based carbon removal.

At IND HEMP, we are identifying pathways that quantify, qualify, and stack credits by linking SOC gains with biochar permanence. This approach not only strengthens credibility in carbon markets but also opens scalable opportunities for rural economies, sustainable supply chains, and climate resilience.

The Carbon Market Challenge: Trust and Transparency

Global carbon markets face mounting scrutiny over the integrity of credits. Many offsets have been criticized for weak baselines, questionable additionality, or short-lived benefits. As a result, investors and regulators are demanding:

- Durability – Carbon stored for 100+ years.

- Transparency – Standardized, referenceable price signals.

- Alignment with Net Zero – Verified removals that neutralize hard-to-abate emissions.

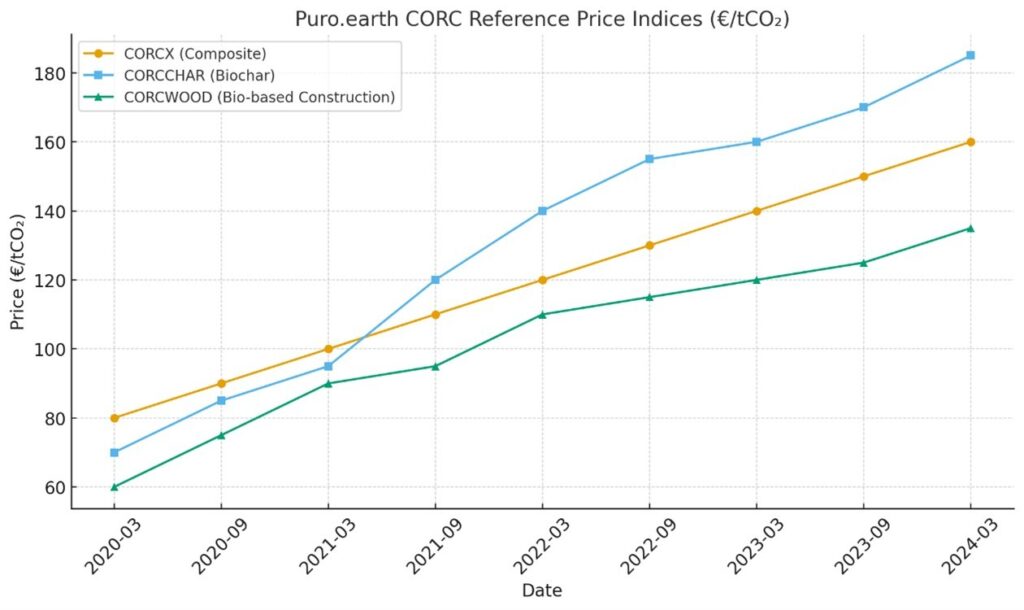

The Puro.earth CO₂ Removal Certificate (CORC) Indexes, launched in partnership with Nasdaq, provide the first reference price family for engineered carbon removals. CORCs track the price of carbon removed through biochar, bio-based construction, and other durable methods.

This kind of index data brings clarity and trust to the market which is a critical step in making carbon removal a mainstream financial asset.

IND HEMP’s SOC Work: Foundations of Credibility

IND HEMP’s Montana-based SOC project, developed under the Verra VM0042 Agricultural Land Management methodology, integrates hemp into traditional crop rotations. Using satellite imagery and physical soil sampling, we quantify SOC changes over time.

Key elements of our approach:

- Measure + Model: Pre- and post-harvest SOC tracked with both lab samples and advanced modeling.

- Remote Sensing Precision: Landsat imagery and thermodynamic sensors provide accurate, scalable monitoring.

- Third-Party Validation: Collaboration with EcoGaia and SoilWatch ensures compliance with global standards for submission to Verra.

This work reflects more than one project, it is a journey to establish soil carbon credibility and all that it can afford across the value chain. By aligning rigorous methodologies and transparent reporting, IND HEMP demonstrates that hemp can anchor high-integrity, soil-based carbon credits.

Fig. 1 – Landsat images of IND HEMP SOC VERRA Project.

The Bridge to Biochar

SOC delivers measurable gains in soil health and medium-term sequestration, while biochar provides permanence, locking carbon into soil for 100+ years, or other applications. Hemp’s dual role as both a rotational crop and a biomass source makes it uniquely positioned for stacked credit pathways:

- SOC credits – Verified improvements in soil carbon.

- Biochar credits – Long-term sequestration validated by standards like Puro.earth.

- Avoided emissions – By replacing residue burning or unsustainable inputs.

This multi-dimensional value creates resilience for farmers and buyers alike, diversifying revenue while advancing climate impact.

Market Context: CORC Indexes & Biochar Pricing

The CORC Index family provides the first transparent benchmark for engineered carbon removal:

- CORCX – Composite index for all CO₂ removal credits.

- CORCCHAR – Tracks the cost of removing one tonne via biochar.

- CORCWOOD – Reflects CO₂ removal from bio-based construction materials.

Data is updated monthly, providing a market reference in €/tCO₂. This creates transparency for buyers and sellers and highlights the premium value of biochar relative to traditional offsets (Puro.Earth, 2025).

Fig. 2 – A line chart titled “Puro.earth CORC Reference Price Indices (€/tCO₂)” showing price trends from March 2020 through March 2024. (Puro.Earth, 2025)

Recent Market Trends:

- Biochar credits generally trade at €100–€200 per tonne CO₂, with European transactions sometimes reaching above €500/t for niche use cases (Puro.Earth, 2025).

- The average 2025 price is approximately $177/tCO₂, up ~35% since 2023 (Sylvera, 2025).

- Latin American forward contracts average $130–160/tCO₂, demonstrating global appetite and regional variance. (Sylvera, 2025)

By tying hemp biomass into this emerging asset class, it is positioned at the intersection of agriculture and carbon finance.

Strategic Case for Hemp + Biochar

Hemp amplifies carbon removal’s potential:

- Reliable Feedstock: Fast-growing, high-biomass output.

- Credit Stacking: SOC + biochar + avoided emissions.

- Co-benefits: Soil fertility, biodiversity, reduced fertilizer reliance.

- Policy Alignment: Supports U.S. climate goals and Paris Agreement targets, while addressing multiple SDGs (2, 12, 13, 15).

Toward a Net Zero Future

The IPCC estimates that 6–10 gigatonnes of CO₂ must be removed annually by 2050 to keep warming below 1.5–2°C. Hemp-based SOC and biochar projects represent scalable, farmer-led solutions that directly contribute to this goal.

IND HEMP’s identified and plausible approach delivers:

- Quantifiable sequestration through SOC monitoring.

- Durable storage via hemp biochar.

- Economic resilience for farmers via premium carbon credit markets.

Conclusion

The future of carbon markets depends on integrity, permanence, and scalability. Hemp offers all three when paired with high quality MMRV (Measurement, Monitoring, Reporting, Verification). By advancing SOC methodologies and pioneering hemp-biochar integration, the industrial hemp industry can shape a new era of transparent, science-driven carbon credits.

This isn’t just about offsets—it’s about creating a trusted framework where agriculture, finance, and climate intersect. Hemp is proving that soil can be more than fertile ground for crops—it can be a foundation for credible, durable climate solutions, that when implemented correctly, has the best net effect for all parties.

Keywords: industrial hemp carbon credits, hemp biochar, soil organic carbon sequestration, Puro.earth CORC index, biochar carbon credit pricing, regenerative agriculture hemp, high-integrity carbon removal.

Citations

- Puro.earth – Biochar Methodology & Carbon Removal Certificates (CORCs)

https://puro.earth/biochar

- Puro.earth & Nasdaq – CORC Carbon Removal Reference Price Index Family (Fact Sheet)

https://nasdaq.com/solutions/carbon-removal-marketplace

- IND HEMP & EcoGaia – IND HEMP Agricultural Hemp Rotation – Montana, Project Design Document

- Sylvera – Biochar Carbon Credit Pricing 2025 Market Update

https://www.sylvera.com/blog/biochar-carbon-credits

- QC Intelligence – Biochar Credit Market Trends & Price Variability

https://www.qcintel.com/carbon/article/feature-biochar-carbon-credit-prices-need-to-rise-not-fall-while-producers-of-the-substance-need-buyers-36047.html

- Onnu – Choosing a Carbon Registry: Why We Went with Puro.earth

https://onnu.com/insights/choosing-a-carbon-registry-8-reasons-why-we-went-with-puro-earth

- Time Magazine – Can Hemp Help Solve the Climate Crisis?

https://time.com/6268420/hemp-climate-solution

- Vox – Carbon Banking & the Role of Biochar

https://www.vox.com/climate/458938/carbon-banking-climate-solutions-biochar-carbon-waste

- Reuters – Policy Push for Carbon Removal Credits

https://www.reuters.com/sustainability/climate-energy/policy-push-carbon-removal-credits-lures-finance-aviation-2024-04-05